Community

The private investment community

primarily consists of venture capital

(VC), private equity (PE) and family

office investment professionals.

Operating Partners align with all three,

but evolved from classic PE buyout

and turnaround firms that have control

investment mandates.

Asia PE funds have trailed EU and

U.S. firms on deal flow, with smaller

transaction size and fewer control

investments – but that is changing.

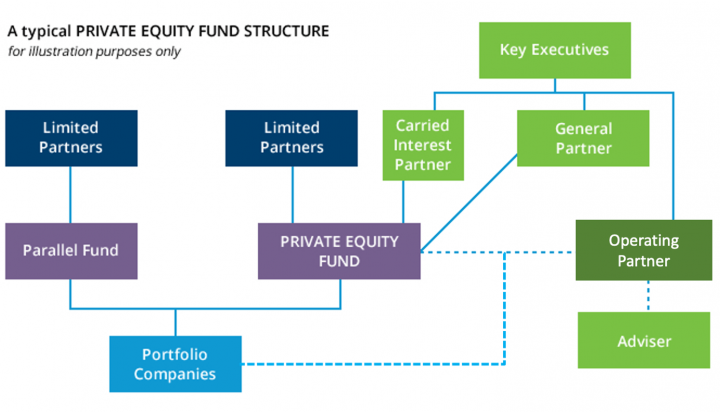

Partnerships

VC and PE partnerships are typically

structured as ten year closed end

funds, not listed on public exchanges,

focusing on institutional investors.

PE fund managers are called general

partners (GPs), investors are referred

to as limited partners (LPs) bound by

a limited partnership agreement.

Operating Partners can be structured

at both the GP and portfolio company

levels, compensated along side both

management and performance fees.

Investments

Portfolio Investments depend upon

the fund’s strategic mandate, sector

focus and can include minority,

majority and/or outright acquisitions.

Operating Partners support upfront

deal due diligence, post-investment

integration, talent development and

operational value creation for exits.

Exits are the barometer of success.

A GP’s track record defines the

partnership’s ability to secure new

capital for future investment funds.

Whitepapers

Global PE Report

Value of Operating Partners

The Operating Partner

Value Creation Primer

Corporate Operating Partner